Top Knot Ventures’ Manica Blain On Why Individual Investors Are Particularly Important For Early-Stage Brands Today

After pitching 20 venture capital firms and receiving a term sheet from one, Indu, a forthcoming teenage beauty brand from Feelunique co-founders Aaron Chatterley and Richard Schiessel, ended up securing $4.8 million in funding from 66 people, including prominent names in beauty and retail. In a recent interview with Beauty Independent, Chatterley explained that beauty and retail veterans grasped the opportunity he presented to them and didn’t require a series of extensive meetings to bring on board.

While collecting funds from 66 backers may be a lot for most founders, Indu’s fundraising strategy of turning to experienced former and current executives, entrepreneurs and individual investors is being repeated across the consumer packaged goods ecosystem as VC funding has dried up. Coming off a propitious run for the beauty industry, many of these people have cash available and generally not as onerous criteria as VC managers to consider when determining where to put their money. And, at a moment in which founders are encouraged to have financially sound brands, they may be getting in on some pretty good businesses.

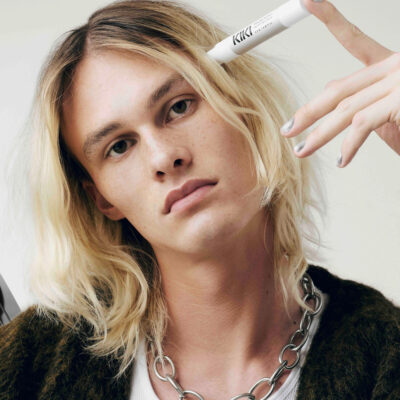

Manica Blain, founder of Top Knot Ventures and co-founder of Campfire Capital, is among the individual investors betting on the beauty industry. She’s written eight checks this year, half in beauty, including for Blanka, a private-label platform that’s raised $2 million. “I’m typically investing $10,000 to $30,000 per deal, so it’s relatively small in a $1 million to $2 million round, but founders view me as a value add,” she says. “I’m pretty helpful. Part of our role as investors is not only to come with capital, but to share our network.”

Beauty Independent picked Blain’s brain about the advantages of individual investors, what founders are overlooking when they try to nab capital, a retail format that makes sense for emerging brands, and why CPG unicorns are becoming almost as dubious as the mythical creatures they’re named for.

What got you into investing?

I started my career in investment banking, which I would say is not atypical, and spent the first five years there, predominantly consumer and retail, and that’s where I fell in love with consumer. I moved over to private equity, spent five years there. I thought I would leverage my skillset and work in-house in corporate development and M&A. It was 2009, and Lululemon very much resonated with me. I was their key demographic, and I was a proud Canadian.

I reached out to them via LinkedIn. In my infinite wisdom, I said, “Here I am, hire me now.” I didn’t hear back right away. I ended up at Onex, a storied private equity firm. Eight months into my gig at Onex, I got a call from Lululemon. I said, “I’m not going to take the job, but can I fly out on my own time and dime to meet you?” I met Lululemon executives in April 2011, but I stayed on at Onex until 2014.

Midway through 2014, I was approached with the idea of building a venture capital fund backed by Lululemon executives. What was happening then was DTC wave 1.0. All these brands were starting to emerge that were digitally native, and they were thinking about stores. Lululemon is known for stores with incredibly productive sales per square foot. They realized they could invest in early-stage businesses as they thought through omnichannel growth.

We called the venture capital fund Campfire Capital, and it raised money and invested in the next wave of retail unicorns. I was 32 years old at the time. I think it’s crazy now as I sit in my 41-year-old skin. It took us 18 months to raise $32 million from 33 current and former Lululemon executives, BDC, the lead institutional investor, and a slew of other retail operators. My partners were Christine Day, the former CEO of Lululemon, John Currie, the former CFO, and Brooke Harley, who was the director of business development.

It was the first of its kind. We were trying to be the Andreessen Horowitz of retail and really lead by being operationally helpful. We invested in a number of companies. A couple of them did really well and others not so well. The two companies that stand out are Cotopaxi and FIGS. FIGS IPO’d a couple of years ago.

From Campfire, I ended up leading venture capital and early-stage investment for the Houssian family’s investment company. They are a large family that built and sold IntraWest Corporation. Then, I took a venture partner role at another consumer-focused fund, BrandProject.

I’ve had two kids back-to-back, and about a year ago, I decided I’ve got these great networks in consumer, I have a really strong niche, why don’t I do my own deals? I don’t need a fund. I’m not operating a fund at all. Top Knot Ventures is my own capital. Even though my checks are relatively small, I can be a part of larger rounds. When I find a deal that needs more than my small checks, I share the opportunity with VCs and family offices.

What are you looking for in investments now?

I’ve become very disciplined in what I’m looking for with indie brands. I’m really focused on loyalty. I pay a lot of attention to cohort analysis and trying to understand the stickiness. Is there a one-time customer that’s come off a discount code or are they coming back?

A deal I just closed was an oversubscribed round for a beauty brand that’s been around since 2015. When I did the cohort analysis, I was amazed to find that 70% of customers came back at least once. Twelve percent to 15% of lifetime value net sales came from customers who’d purchased 10 times or more. That’s really strong.

It’s also a founder that’s bootstrapped the business. I have seen a lot of founders who come to me and say, “Here’s what I want to do, help me get off the ground,” but this is a founder who put capital at risk and bootstrapped the brand to be profitable. It has very strong LTV to CAC metrics and a very smart deployment of capital, never wearing the growth-at-all-costs hat.

What do you think about in terms of distribution?

You can’t just be online. The new rule for brands is you have to have an omnichannel approach from day one. The rules of the game today are very different than they were a decade or more ago. We are looking for profitability now as investors. We want to know that you aren’t burning through cash. We want to see the markings of a brand that is long lasting and that you are really building a connection with a consumer rather than here today, gone tomorrow.

I’m looking for businesses that have strong financial business models, strong margins. It’s OK at a certain point to be spending a lot, but what’s sustainable? The money that you need around the corner, if you are burning through cash, there’s uncertainty around that.

When I come into a round, I ask, “Do you feel comfortable around the corner for the brand? Can the brand execute on what it needs to do to get around the corner?” Two years ago, I would meet witih founders who would give me a pitch deck in a category they wanted to penetrate, and they would have no website and a $10 million valuation. That’s not happening anymore. I want to pay for what you accomplished, not for what you will accomplish.

Brands are turning to individual investors with experience in the consumer arena for capital. What’s your take on what’s going on?

I think it’s really smart. For a variety of reasons, the VC market is slow right now. In the same way that founders are trying to understand where their next round is coming from, venture firms are trying to understand where their next fund will come from. For ease and quickness, I think there’s a tremendous amount of merit in approaching high-net-worth individuals and executives who have seen this movie before and like the asset class.

They can not only participate in the round, they can bring in their networks to close the round. A lot of that is happening in the market, and founders are including it in their fundraising strategies in a way that’s getting the rounds done as long as their valuation expectations aren’t out of left field.

What are you seeing with valuations?

A couple of years ago in the beauty space, it was in the 5X to 10X range for topline and one year forward net sales value. It would not be uncommon to see multiples like that because beauty is a category that investors love, there are a lot of different strategic opportunities, and it’s high margin. On the same deal today, all else equal, I would say the valuation is half that multiple applied to current year sales.

I’m not interested now in valuing you on 12 months forward. Maybe I will give you credit for the rest of this year if it’s obvious things are going a certain way, but I’m looking at your last 12 months and your current year on a net sales basis. That’s an important differentiator as well.

What do founders tend to miss about investors?

There’s a lot of focus on valuation, but there are other things that are important, too. Something I really care about is the option pool because I know an early-stage founder needs to build a team and being able to share equity upside can be important in attracting and retaining the right talent. In the early stage, I’m talking sub-$5 million in sales, a healthy option pool is something a founder doesn’t often think about, but an investor will because it affects ultimate ownership levels.

Typically, at the seed stage, you want 10% for your option pool. I’ve seen as low as 6% to 8% and as high as 15%. So, if an option pool isn’t in place before I put money in, I know my investment will face an almost immediate hit of about 10% or more when the option pool is ultimately created. Investors are going to price that in, and so a founder should think about that as well.

Another thing relating to ultimate ownership levels I often see founders miss is the overhang effect from the conversion of one or more SAFE rounds as they think about the valuation of their first priced round—and specifically the pre-money valuation.

I’ll use an example with some round numbers as that may be helpful to illustrate this point. Let’s say a founder has already done three SAFE rounds, and they’re now thinking about valuation of their first priced round, and let’s say they want to raise $5 million. Let’s say this founder is expecting to do $15 million in sales and thinks a 3X pre-money valuation multiple is fair. So, that’s $45 million pre-money and $50 million post-money, right? If I’m an investor coming in with $5 million of a $50 million post-money, I’m looking for a 10% ownership stake ($5 million of $50 million equals 10%), right?

Well, the investor coming into this priced round is going to be fixated on ensuring the round is truly a $50 million post-money, and when they price the round on a pre-money basis, they will factor in the conversion of those three SAFEs. As a result, the pre-money valuation of this particular round will end up being much lower than $45 million. How much lower? Well, that will depend on the size of each of those three SAFE instruments and their respective valuation caps, but it’s likely to be materially lower than the founder’s desired $45 million pre-money valuation.

Do you think things will get less tight on the VC front toward the end of the year?

I’m hopeful that they will. I know a number of funds in the market trying to raise right now. Their business is to be able to have the dry powder to invest in businesses, and if they run out of that, they will no longer be in business. That’s a real thing. It really depends on the ability of some of the VC firms to obtain their own funding so they can be more active. Do they have a good outlook on their ability to raise their next fund?

Another big piece is there is a heavy focus on distributions to paid-in capital. In the fund world, what LPs care about is, how much money have you returned back to me? If you have had a fund since 2018 and 2019, but you haven’t returned a penny yet, the expectations on the LP side are becoming more stringent. When a VC fund manager is underwriting a new investment, they are very much focused on exit. The clock is ticking. They want a strong bet to return capital to investors in a timeframe that’s shorter than what they’ve delivered so far.

I’ve seen many pitch decks for funds, and it’s not looking good on the distributions to paid-in capital side. If you have a fund that’s $50 million, and let’s say you’ve spent the whole $50 million and distributed back $10 million, that’s pretty crappy DPI. That’s .2. LPs are looking at positive DPI. If they’ve given you a dollar a few years ago, have you at least been able to give a dollar back?

At Campfire Capital, we ended up in a wind-down situation, and so we only deployed 25% of our capital. By the time it returned capital to investors, it was probably in the top 15% to 20% of all 2015 funds in Canada on a DPI basis. The DPI was about 1.1X on a net basis, including the fees and expenses. That means that, for every dollar that an LP gave me, I gave them back $1.10.

What categories particularly interest you for investments?

Right now, fertility is something that is interesting to me. On the opposite end of the spectrum, death is very real to me with the stage that I’m at with my parents. The modernization of that experience is interesting to me. I’ve invested in Eirene, which is modernizing the cremation experience. Guaranteed Hospice I hold through a fund. As an investor, you lean into things you understand and are going through yourself.

A huge opportunity right now that I’m focused on is menopause and that’s because I’m 41 and it’s the next thing on my list that I think about. The same people who went through the fertility journey are going through menopause next, and we are going to be loud and proud about it to make that experience more pleasant than it has been to date.

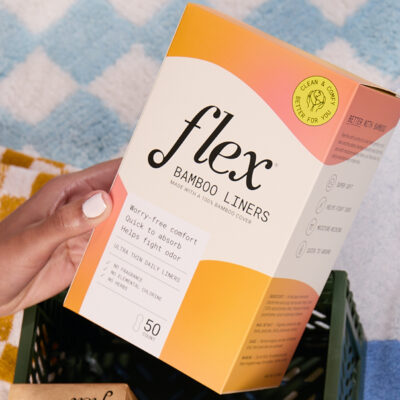

Also, commerce enablement, whether it be tech or a platform. I like the idea of Blanka that’s approaching it in a different way. There are all these indie brands with one or two hero products that have raised capital, but, when it comes to expanding a product line into adjacent categories with the MOQ requirements and fulfillment necessary, what can you do to help them?

Every brand I’ve invested in is like, yes, we would like to add brushes, for instance, to our roster, but our capital is tied up, and we can’t hit the MOQs. You can go to Blanka and very quickly have your logo on a best-in-class adjacent product.

What should be done to improve the percentage of funding going to female founders?

To me it’s, it’s really simple. You need more female check writers at the table. It’s not just the fund managers, but it’s who’s writing the checks into the funds. Who are the LPs? Who are the decision makers at large institutions? The institutional pool that exists is largely controlled by men.

Women know how to make money and run businesses. That’s my experience. I’ve had success backing women, but I think there aren’t as many women that write checks. The more women that write checks in brands and in funds, you will see more change. From when I started Campfire, there are many more female fund managers out there raising their own funds and they’re going to invest in female founders. I’m so excited for that. We have a long way to go, but I’m proud of the progress we have made to date.

When brands are weighing opening stores, what should they think about?

The founders that are doing it in a smart way are doing temporary seasonal stores. I love the founders of Left On Friday, the business and the brand. They’ve had summer seasonal stores, and they did a pop-up at a workout café called TurF.

Brands are very cleverly negotiating seasonal locations and shorter commitments. I think you need to walk before you can run. These are cool ways to test the market. It’s a low-cost way to do a store experience, where the customer can try on the brand and experience it in real life. It’s hard to convey the quality of something until you try it.

What trend in the market are you watching closely?

You are starting to see exits happen earlier on. A founder might have come from a big beauty or big retail company, and they are looking to sell earlier rather than later. They don’t want to fall into the Glossier trap. There’s a focus on it from the investor standpoint, too, because they may have invested in brands that didn’t exit. Gone are the days of being a unicorn before you exit.

The big consumers companies are going to be pretty careful about waiting too long about acquisitions because they don’t want to overpay, and they want to benefit from synergies. Similarly, brands don’t want to wait too long to entertain the idea of an exit because they need to provide liquidity to their investors. There’s a lot of pressure to transact earlier on, and I’m interested to see how that plays out.

And that’s one of the reasons I’m excited to be investing right now. If you look at venture returns, the best returns are made in times like these. If you look at 2008, 2009 vintages, the DPIs were the strongest. Valuations have come down now, but the opportunities are still there for strong businesses with strong fundamentals and strong founders. If you have the capital to invest in the right opportunities, now is the time.

Leave a Reply

You must be logged in to post a comment.